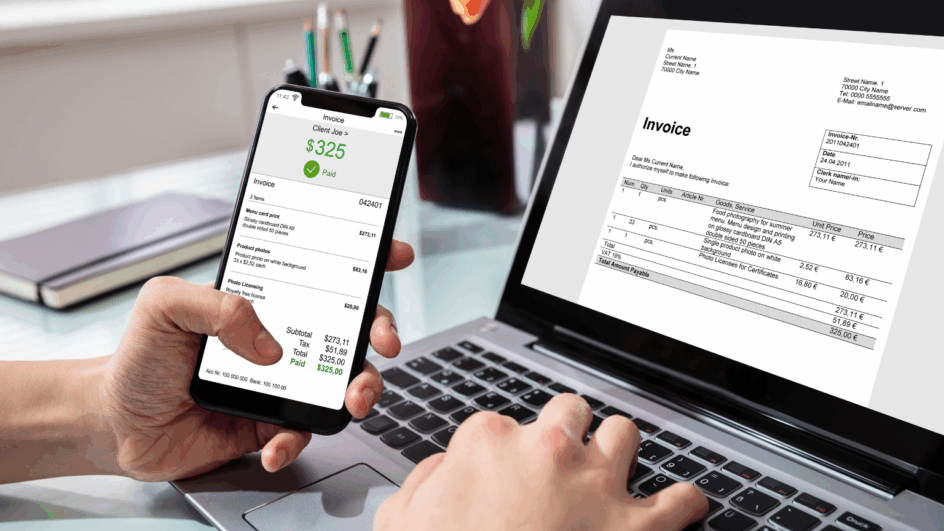

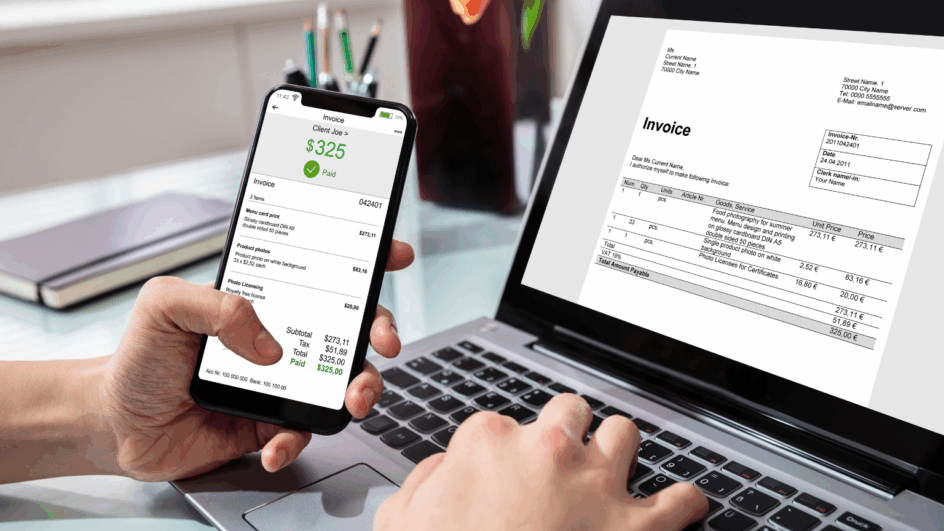

Invoices do more than request payment – they create the digital records you’ll rely on for Making Tax Digital for Income Tax Self Assessment (MTD for ITSA). From 2026, many sole traders and landlords will need to keep those records digitally and send quarterly updates through compatible software. MTD focuses on how you record…

A detailed look at HMRC’s penalty regime for Making Tax Digital for Income Tax Self Assessment (MTD for ITSA), with practical examples and ways to avoid charges. *This article is accurate as of 11 January 2026. HMRC may update Making Tax Digital (MTD) rules, deadlines and penalties. If you’re reading this after that…

Making Tax Digital for Income Tax (MTD for ITSA) is HMRC’s new way for sole traders and landlords to keep records and report income using compatible software. Mandation starts in April 2026 and expands in phases. This guide covers who must join and when, what digital records mean in practice, how quarterly updates and…

MTD (Making Tax Digital) isn’t one rule – it’s two separate regimes aimed at different taxes. MTD for VAT already applies to all VAT-registered businesses, and it requires digital VAT records and VAT Returns filed through compatible software. MTD for Income Tax Self Assessment (MTD for ITSA) is a separate requirement for sole…

Making Tax Digital for Income Tax (MTD for ITSA) requires taxpayers within scope to keep digital records and submit via compatible software. If you need to implement software, choose a tool that is compliant and reduces day-to-day admin. The checklist below follows HMRC guidance and is written as a practical selection checklist for sole-traders…

Can landlords use bridging software for MTD? Short answer: HMRC permits a spreadsheet-plus-bridge setup if your records are digitally linked. In day-to-day use, most landlords find an all-in-one MTD app smoother: one place to record income/expenses, see running tax estimates, and submit – without maintaining ranges, links, or workbook versions. Join the EasyInvoice…

For many landlords, the move to Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) raises a practical question: can you keep using spreadsheets and still comply? HMRC allows this if you use bridging software with proper digital links. In simple terms, the bridge is the connector that lets a spreadsheet send updates…

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) changes how sole traders and landlords keep records and send information to HMRC. Instead of only one annual return, you’ll keep digital records during the year, send quarterly updates from compatible software, then make your end-of-year submission through that software by 31 January…

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) brings a new, points-based system for late submissions and a separate regime for late payments. Below we explain MTD penalties, appeal rights and what happens after a missed MTD deadline. *This article is accurate as of 20 November 2025. HMRC may update…

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is HMRC’s programme for sole traders and landlords. This guide explains the MTD records required, how digital record keeping works, and the MTD compliance requirements. 1) What digital records are required for MTD for ITSA? You must keep digital records (in…

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) sets specific rules for keeping digital records and sending updates to HMRC. In short: you must record your self-employed and/or property income and expenses in compatible software, keep those records in a digital form, and submit quarterly updates plus a year-end return through…

MTD for ITSA (Making Tax Digital for Income Tax Self Assessment) is the UK government’s initiative to modernise the tax system for sole trades (i.e., self-employed individuals who trade as sole trades) and landlords. It replaces annual paper or online returns with digital record-keeping, quarterly updates, and a final declaration through HMRC-recognised app. …

1) How to register for MTD (quick MTD registration guide) Go directly to HMRC’s “Sign up for Making Tax Digital for Income Tax” service to start the HMRC MTD sign-up. As a next step, choose MTD-recognised app, then sign in with your Government Gateway details and follow the prompts – HMRC will confirm your…

From April 2026, the UK tax system enters a new digital era. Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) will become mandatory for sole traders and landlords with annual income above £50,000. This reform does not eliminate the yearly process entirely but adds new layers to it. Instead of submitting…

1) Who must join MTD for Income Tax in April 2026? From 6 April 2026, the start date of Making Tax Digital (MTD) for Income Tax Self Assessment (ITSA), the rules will apply to sole traders and landlords whose combined gross income from self-employment and property exceeds £50,000, based on the 2024–2025 tax year.…

An easy-to-understand introduction to Making Tax Digital for Income Tax Self Assessment (MTD for ITSA): what it is, why it was introduced, who it applies to, the key MTD deadlines, and what happens if you do not start using compatible software in time. What is Making Tax Digital (MTD)? Making Tax Digital…

If your business is doing well locally, you will be primed to take it abroad to open to new customers and markets. If you’re you’re one of those small business owners who are wondering how to take their sales abroad, you’ve come to the right place. In this article, we will share a few tips…

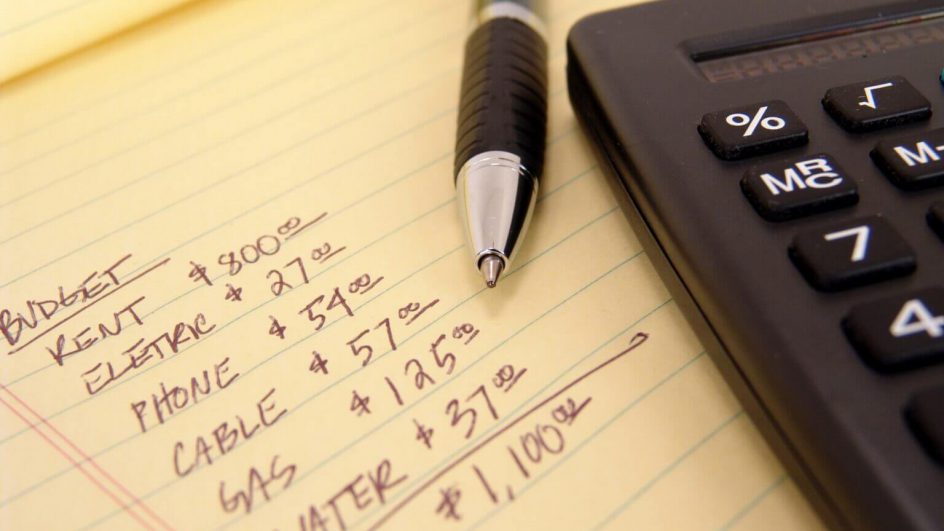

Cash is like fuel for business. It keeps it going. It’s the money that flows in and out of your business every day. Based on it, we can distinguish which business will be able to last and which one will not. If you’re wondering if you should create a budget to watch over cash for…

Back in the day, you would develop an exciting product, find a storefront, put an advert in the Yellow pages or newspapers and wait for the phone to ring or clients to walk in the door. Those days are gone. The Transition from Brick-and-Mortar to Online At a brick-and-mortar store, you would meet your clients…

We believe that Cash Management is everything to a business, large or small. After all, companies do not fail because they are not profitable, lack good ideas or have bad management; they fail because and when they run out of cash. The golden rules of cash management are: Guard your nest egg. Every business starts…

The world would be a better place if everyone paid their invoices on time, right? When you sell your product to a customer, they must pay you for it – it is your main objective to get paid and receive the money to your bank account as quickly as possible. Well, welcome to the real world.…

“Cash is king” is an age-old saying that is still around and very true when it comes to both the success and the failure of businesses. Most people start a small business and focus on becoming profitable as fast as possible. It’s just how things are and there is nothing wrong with that, we all…

Are you fed up with working for somebody else in your 9 to 5 job? Are you thinking of setting up your own business? If you’re ready to take this big step, but you’re still unsure about how and where to start – we’ve got you covered. In this article, we will take you step-by-step…