From Local to Global: How to Take Your Small Business Sales Abroad?

If your business is doing well locally, you will be primed to take it abroad to open to new customers and markets.

If you’re you’re one of those small business owners who are wondering how to take their sales abroad, you’ve come to the right place. In this article, we will share a few tips and best practices on how to expand your business.

Things To Know Before Going Global

Before you create your own plan on how to start selling your products or services to international customers, there are things that every small entrepreneur needs to learn, such as:

- Export licenses

- Currency exchange rates

- Customs duties

- Overseas shipping costs

- The acceptability of your products or services in the foreign market

- Culture

Usually, this is the moment you’d start googling things just to find plenty of information… relevant only for businesses that are already pretty big and want to get bigger. Topics, such as recruiting staff, finding offices, partnerships, market research, the impact of globalization, hedging currency risks, and so forth. But that’s all for big companies – what about the new kids on the block?

What to Consider Before Expanding A Local Business

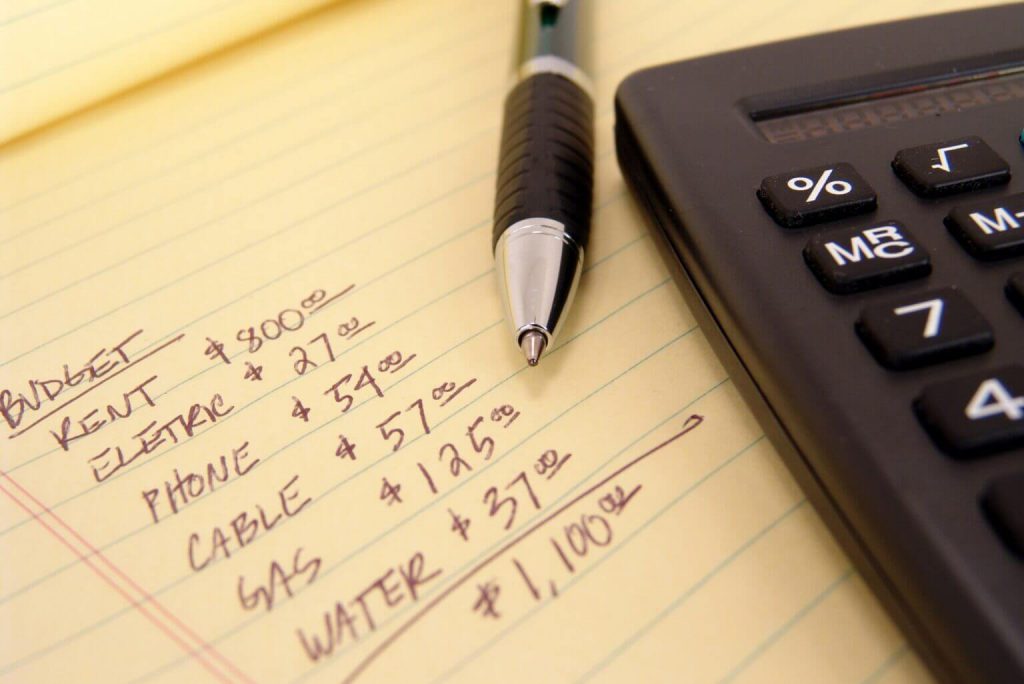

Let’s assume that you already have a great product or service. You have done well in your home market. Inquiries have arrived from abroad to your website, and you need to decide whether or not to accept the sales and fulfill the orders. But you are not big enough just yet to have overseas offices or staff. When pondering if international expansion is right for you, consider these four factors:

- Are there any regulatory barriers between your country and theirs that might make your product or service unsuitable?

- Can you make money? This is especially important if you are based in a high-cost country but selling into one with lower wages.

- Is communication a barrier, or can you use your own language, or perhaps English?

- Shipping costs and customs duties. Will the customer accept these additional charges?

- Foreign Currency issues:

- Will your client accept an invoice in your home currency?

- If not, what currency will you put on your invoice, their money, or perhaps $US?

- Will your bank accept payments in a foreign currency?

- Do you have a bank account to receive payments in whichever foreign currency you use?

- When you send the invoice in a foreign currency, you will have worked profitability based on an exchange rate assumption. What if this exchange rate is different when you receive payment?

- Do you have to charge sales tax on your invoice?

Some countries with strong state or provincial identities can pose regulatory hurdles for businesses. An example of such – and only an example – is Canada that consists of 10 provinces and 3 territories covering a vast geographical area. Each province operates somewhat like an independent nation with its own laws, rules, and regulations designed to protect provincial interests and defend local autonomy.

As long as these regulations are meant to protect a lot, they can sometimes limit certain aspects of inter-provincial trade. As a result, businesses that are based and operate within one province may find it easier to do business in the United States or even overseas than within other Canadian provinces. To explain this further, take the case of alcoholic beverages, such as wine, beer, and distilleries. Similar trade barriers exist in dairy products and chicken. This is because every province sets its own rules for relatively mundane things like health and safety regulations, healthcare, driving license rules, speed limits, gun laws, and so forth. As mentioned earlier, Canada isn’t the only example – the case may be similar in the United States where inter-state trade barriers also exist.

Yes, we have posed more questions than answers, but without knowing the specific export market you may be considering, it is impossible to answer them all. For example, do you have to charge Sales tax (or VAT, GST, PST, HST, whatever the local tax is called) in an export sale? In general, the answer is no, unless you have a physical presence (i.e., staff, a building, or a legal entity of some kind) in that foreign country. For cross-border sales within the EU, here is a useful guide.

Concerning regulatory issues. Once again, no universal solution is available. But you can obtain lots of useful information from cleverly worded Google searches.

This blog is not intended to be a sales aid. However, we do have active subscribers in 70 countries, and you would not normally consider some 50 of them to be English speaking – see the complete list in the FAQ section. It appears that they use English as their language of commerce, render cross-border invoices in English, and in the main, bill in US Dollars, or Euros.

Summary

Expanding into an unknown foreign market can be very lucrative, yet terrifying. It can pose many challenges that you will need to overcome. In addition to what we discussed in this post, you can read other blog posts from EasyInvoice with more tips on running your business and accounting in general. Be prepared for clear sailing. Always.

Yes, we use

Yes, we use